Your Does medicaid look at tax returns images are available. Does medicaid look at tax returns are a topic that is being searched for and liked by netizens now. You can Download the Does medicaid look at tax returns files here. Get all royalty-free images.

If you’re looking for does medicaid look at tax returns images information linked to the does medicaid look at tax returns interest, you have pay a visit to the right blog. Our site always gives you hints for viewing the highest quality video and image content, please kindly surf and find more informative video content and images that fit your interests.

Does Medicaid Look At Tax Returns. But just because the same Congress passed the tax code and the Medicaid code dont think that the two actually agree with each other. Every child under the age of 21 that you are taking care of even if they are not listed as dependents on your taxes can be included as part of your household. Citizen national or resident alien or a Canadian or Mexican resident. A tax filer a tax dependent.

Qualified Medicaid Waiver Payments On A W 2 Show A Community Filing Taxes Turbotax Tax Software From pinterest.com

Qualified Medicaid Waiver Payments On A W 2 Show A Community Filing Taxes Turbotax Tax Software From pinterest.com

Do parents count as household income. July 13 2017 Marketplaces Medicaid and CHIP all use MAGI to determine a households income for eligibility. Pregnant women are listed as such for proper coverage. The only way your income would be divided by 12 months is if your income is seasonal meaning you only work certain months out of the year. You have up to 60 days to enroll your newborn. But just because the same Congress passed the tax code and the Medicaid code dont think that the two actually agree with each other.

Does Medicaid look at your taxes.

When you apply for Medicaid benefits theres a look-back period where Medicaid reviews things like account statements deeds and tax returns looking for asset or cash transfers of non-exempt resources including gifts to others. Medicaid determines an individuals household based on their plan to file a tax return regardless of whether or not he or she actual files a return at the end of the year. Does Medicaid look at your tax returns. This means that a Medicaid recipient can give the money to an adult child for travel to a valued charity or to a grandchild for college within this timeframe without risk of losing Medicaid benefits. For each individual applying for coverage Medicaid looks at whether he or she plans to be. Medicaid will look back 5 years and add up all gifts or transfers.

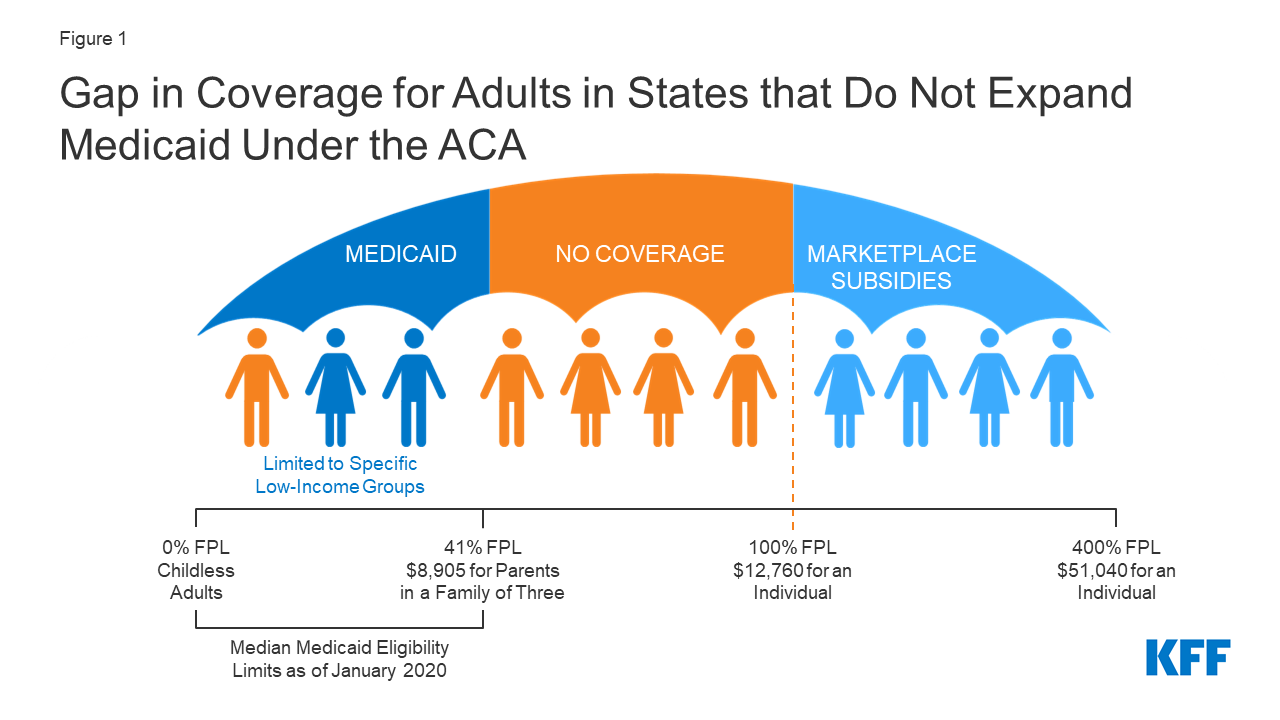

Source: kff.org

Source: kff.org

For each individual applying for coverage Medicaid looks at whether he or she plans to be. Over 14000 you either pay a gift tax or use up part of your exclusion discussed more fully below. Does Medicaid look at your taxes. For each individual applying for coverage Medicaid looks at whether he or she plans to be. Does Medicaid look at your taxes.

Source: pinterest.com

Source: pinterest.com

Pregnant women are listed as such for proper coverage. Citizen national or resident alien or a Canadian or Mexican resident. Start with your gross income which is your total taxable income. For each individual applying for coverage Medicaid looks at whether he or she plans to be. Does medicaid look at my tax return.

Source: pinterest.com

Source: pinterest.com

All tax situations are included Basic Beginner friendly Step-by-step guidance Max refund fast 0 1499 per state Advanced Home ownership Max creditsdeductions Earned Income Credit 0 1499 per state Self-Employed Freelancers Small businesses Contractors 0 1499 per state Start Free Return Pricing Pay with your refund or credit card. See full version. Pregnant women are listed as such for proper coverage. Start with your gross income which is your total taxable income. It is also important to realize that the burden is on the Medicaid applicant to provide any of the requested information or benefits will be denied.

Source: pinterest.com

Source: pinterest.com

Medicaid also does not require people to file a federal income tax return in previous years. If you have custody of the children and you have no income then you would qualify. Pregnant women are listed as such for proper coverage. Unborn children Do not list unborn children as part of your household. July 13 2017 Marketplaces Medicaid and CHIP all use MAGI to determine a households income for eligibility.

Source: pinterest.com

Source: pinterest.com

Yes in some cases you can still claim your mom as a dependent even if she is a Medicaid recipient. The five year look-back that scrutinizes tax returns and bank statements is part of the process of requesting Medical Assistance Medicaid but seems invasive to most applicants. Medicaid will look back 5 years and add up all gifts or transfers. The Tax Relief Unemployment Insurance Reauthorization and Job Creation Act of 2010 provides that income tax refunds are countable as income for any federal program including Medicaid. Who claims the children on the tax return should not have any baring on Medicaid.

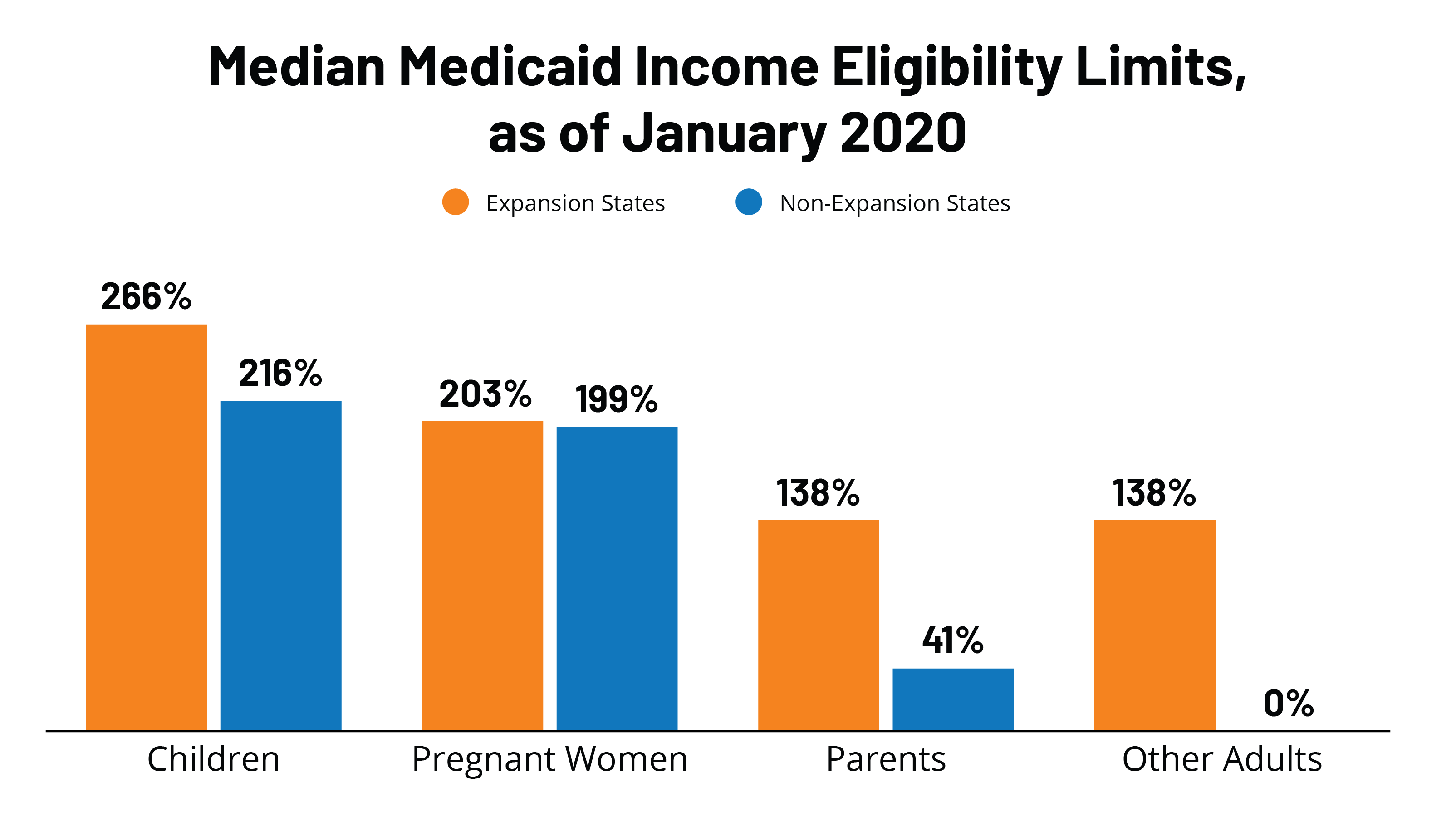

Source: kff.org

Source: kff.org

See full version. It handles complex accounting rules and is extremely reliable dummies has always stood for taking on complex concepts and making them easy to understand. But just because the same Congress passed the tax code and the Medicaid code dont think that the two actually agree with each other. The Tax Relief Unemployment Insurance Reauthorization and Job Creation Act of 2010 provides that income tax refunds are countable as income for any federal program including Medicaid. You would only need to make a report on your federal return if you had Marketplace insurance and a Form 1095-A.

Source: turbotax.intuit.com

Source: turbotax.intuit.com

This means that income tax refunds can be gifted 12. Neither a tax filer nor a dependent. You would only need to make a report on your federal return if you had Marketplace insurance and a Form 1095-A. Medicaid will look back 5 years and add up all gifts or transfers. Unborn children Do not list unborn children as part of your household.

Source: nyestateslawyer.com

Source: nyestateslawyer.com

However in order to claim this tax credit the following criteria must be met. Who claims the children on the tax return should not have any baring on Medicaid. Furthermore AVS searches for possible transfer of assets that were in violation of the look-back period. Medicaid also does not require people to file a federal income tax return in previous years. Citizen national or resident alien or a Canadian or Mexican resident.

Source: in.pinterest.com

Source: in.pinterest.com

Unborn children Do not list unborn children as part of your household. MAGI stands for Modified Adjusted Gross Income. This means that a Medicaid recipient can give the money to an adult child for travel to a valued charity or to a grandchild for college within this timeframe without risk of losing Medicaid benefits. Every child under the age of 21 that you are taking care of even if they are not listed as dependents on your taxes can be included as part of your household. Neither a tax filer nor a dependent.

Source: pinterest.com

Source: pinterest.com

The only way your income would be divided by 12 months is if your income is seasonal meaning you only work certain months out of the year. Your mom is a US. Does Medicaid look at your tax returns. It should become as does medicaid look at my tax return as writing a check or creating an invoice i ve been using. However in order to claim this tax credit the following criteria must be met.

Source: ru.pinterest.com

Source: ru.pinterest.com

The five year look-back that scrutinizes tax returns and bank statements is part of the process of requesting Medical Assistance Medicaid but seems invasive to most applicants. Does Medicaid look at your tax returns. Furthermore AVS searches for possible transfer of assets that were in violation of the look-back period. Does Medicaid look at your taxes. For each individual applying for coverage Medicaid looks at whether he or she plans to be.

Source: pinterest.com

Source: pinterest.com

When you apply for Medicaid benefits theres a look-back period where Medicaid reviews things like account statements deeds and tax returns looking for asset or cash transfers of non-exempt resources including gifts to others. If you have custody of the children and you have no income then you would qualify. However if your neighbor suddenly had a new SUV and RV valued at more than 100000 you might ask if hed won the lottery. Federal tax refunds are disregarded for 12 months from their receipt for purposes of determining eligibility for federally funded assistance programs like Medicaid or SSI. Medicaid also does not require people to file a federal income tax return in previous years.

Source: pinterest.com

Source: pinterest.com

Citizen national or resident alien or a Canadian or Mexican resident. Medicaid determines an individuals household based on their plan to file a tax return regardless of whether or not he or she actual files a return at the end of the year. What is the monthly income limit for Medicaid in Michigan. For each individual applying for coverage Medicaid looks at whether he or she plans to be. What is SC Medicaid number.

Source: healthreformbeyondthebasics.org

Source: healthreformbeyondthebasics.org

The Tax Relief Unemployment Insurance Reauthorization and Job Creation Act of 2010 provides that income tax refunds are countable as income for any federal program including Medicaid. Medicaid also does not require people to file a federal income tax return in previous years. The five year look-back that scrutinizes tax returns and bank statements is part of the process of requesting Medical Assistance Medicaid but seems invasive to most applicants. Over 14000 you either pay a gift tax or use up part of your exclusion discussed more fully below. Based on their plan to file a tax return regardless of whether or not he or she actual files a return at the end of the year.

Source: pinterest.com

Source: pinterest.com

The system also considers Medicaids 5-year look-back period relevant information can be found in the next paragraph and looks for financial accounts that were closed during the 5 years immediately preceding the date of ones application. Federal tax refunds are disregarded for 12 months from their receipt for purposes of determining eligibility for federally funded assistance programs like Medicaid or SSI. What is the monthly income limit for Medicaid in Michigan. No problem at least if it is a federal tax refund. Start with your gross income which is your total taxable income.

Source: pinterest.com

Source: pinterest.com

Medicaid qualifying deals with your income and assets to see if you qualify. For each individual applying for coverage Medicaid looks at whether he or she plans to be. Unless they were made to an exempt transferee eg a disabled. Medicaid also does not require people to file a federal income tax return in previous years. A tax filer a tax dependent.

Source: pinterest.com

Source: pinterest.com

Employee Tax Expert February 12 2020 815 AM On your federal return this has no impact in 2019. Refunds are also not countable as a resource for Medicaid qualifying purposes when received or for the period of 12 months thereafter. All tax situations are included Basic Beginner friendly Step-by-step guidance Max refund fast 0 1499 per state Advanced Home ownership Max creditsdeductions Earned Income Credit 0 1499 per state Self-Employed Freelancers Small businesses Contractors 0 1499 per state Start Free Return Pricing Pay with your refund or credit card. Unless they were made to an exempt transferee eg a disabled. Based on their plan to file a tax return regardless of whether or not he or she actual files a return at the end of the year.

Source: pinterest.com

Source: pinterest.com

July 13 2017 Marketplaces Medicaid and CHIP all use MAGI to determine a households income for eligibility. The Tax Relief Unemployment Insurance Reauthorization and Job Creation Act of 2010 provides that income tax refunds are countable as income for any federal program including Medicaid. Does Medicaid look at your tax returns. A tax filer a tax dependent. Yes in some cases you can still claim your mom as a dependent even if she is a Medicaid recipient.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title does medicaid look at tax returns by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.